It has almost been one year since my last entry. Wanted to use the Christmas holidays to reflect and look back to 2022 and review what happened to my portfolio and personal life. Overall, it has a year of high expenditures and bad portfolio performance. Yet, the single best year of my life. The top highlights were:

- Had a baby girl

- Bought a house

- Moved from a big city to my hometown.

- Bought a car.

- Connected with close friends and family like never before.

- Learned home repairs/construction (plumbing, electricity, flooring, painting, sealing, …).

- Achieved the highest net worth, mostly due to our high income.

Finances

Net worth

Not such a great, year, moved from 469K€ to 474K€ this year if you take into account the passive (equity of the house) or 405K€ if you don’t. Mostly, due to the bad performance of all my financial assets (variable income, fix income, cryptocurrencies, and crowdlending).

I got a total of 87K€ of after-tax income from my work (as cash and stock). This was less than last year due to having a high percentage paid as RSUs, even though my total compensation is higher. This high income avoided a catastrophic decrease in my net worth.

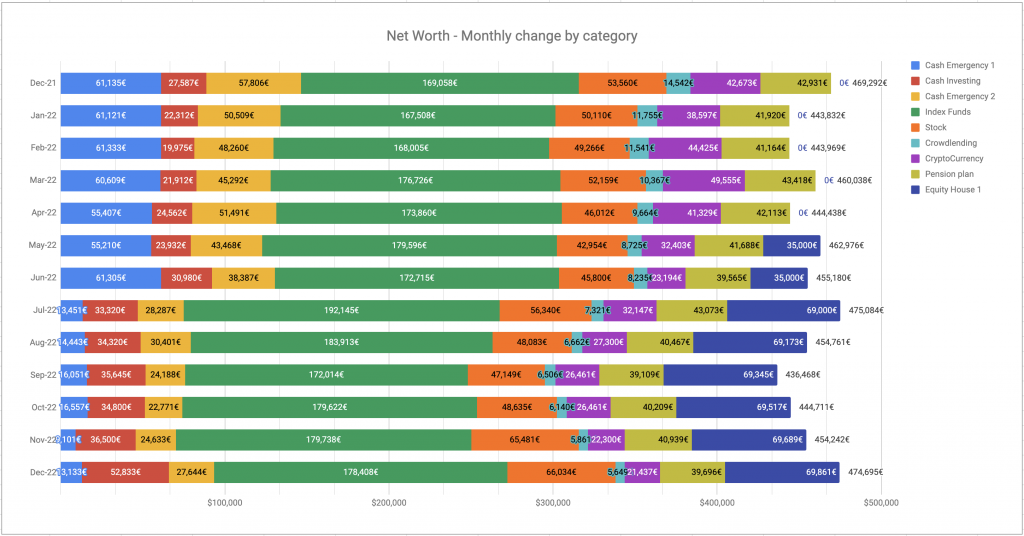

The following plot tracks the net worth monthly change per asset category. Even though we used a lot of cash mid-year to buy the house, we are still holding and not investing as much as we can, in case we have opportunities or a bear market next year.

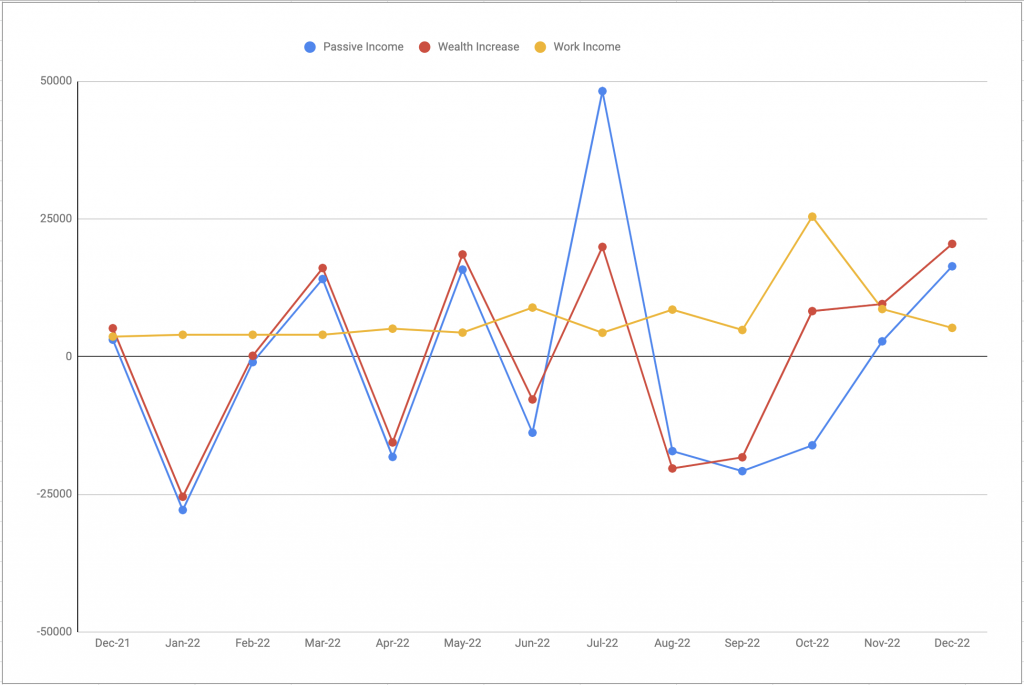

The following plot tracks how my net worth moved per month, negative returns dragged my net worth to negative values fairly consistently across the year.

Spending and Saving

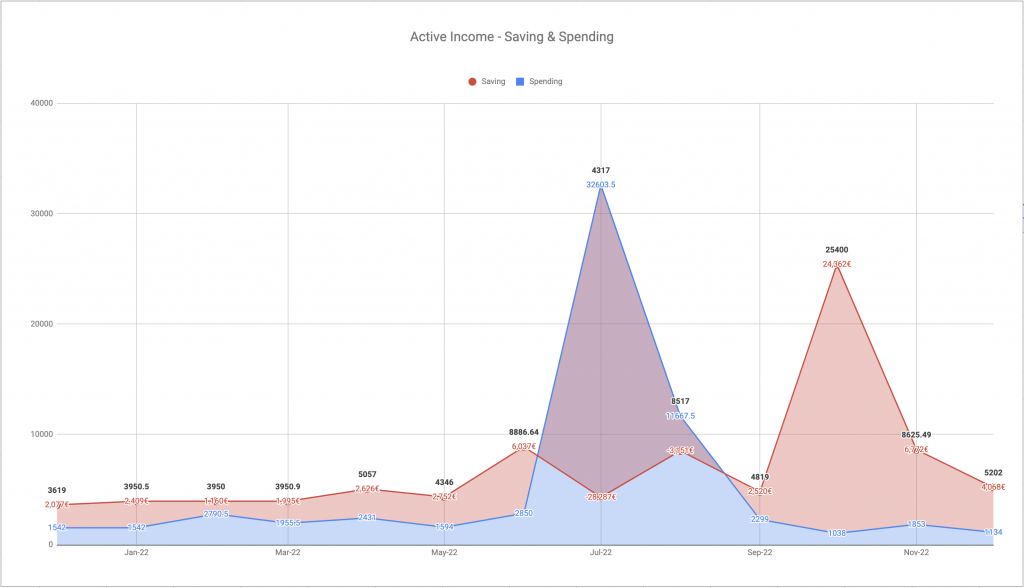

The next plot shows my active salary as the total, what part was spent, and which one was saved. Fairly consistently saving +50% of my salary every month except the months when we bought the house and car.

Asset Allocations

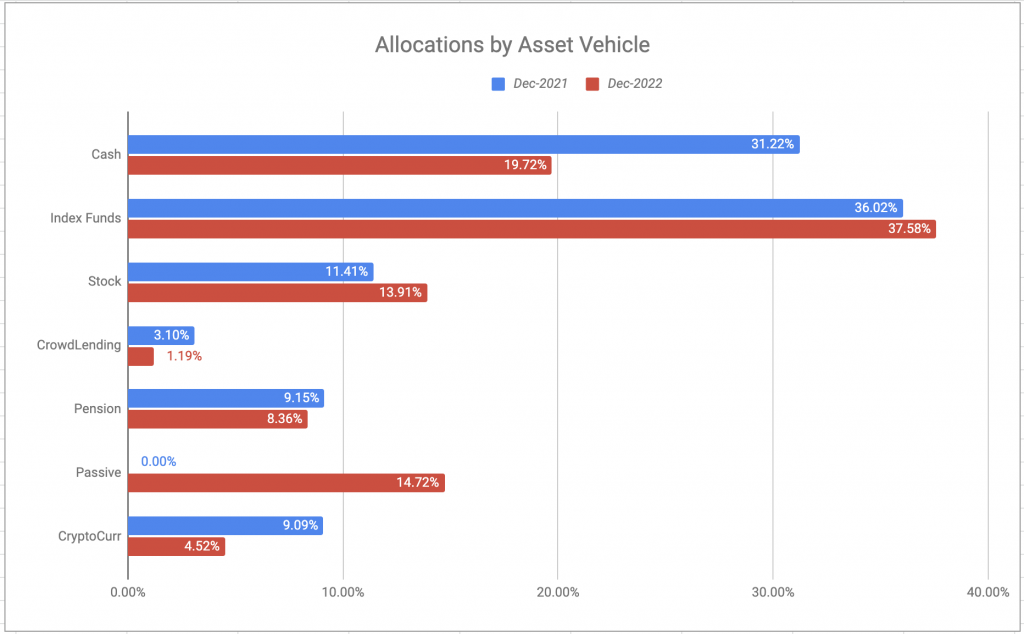

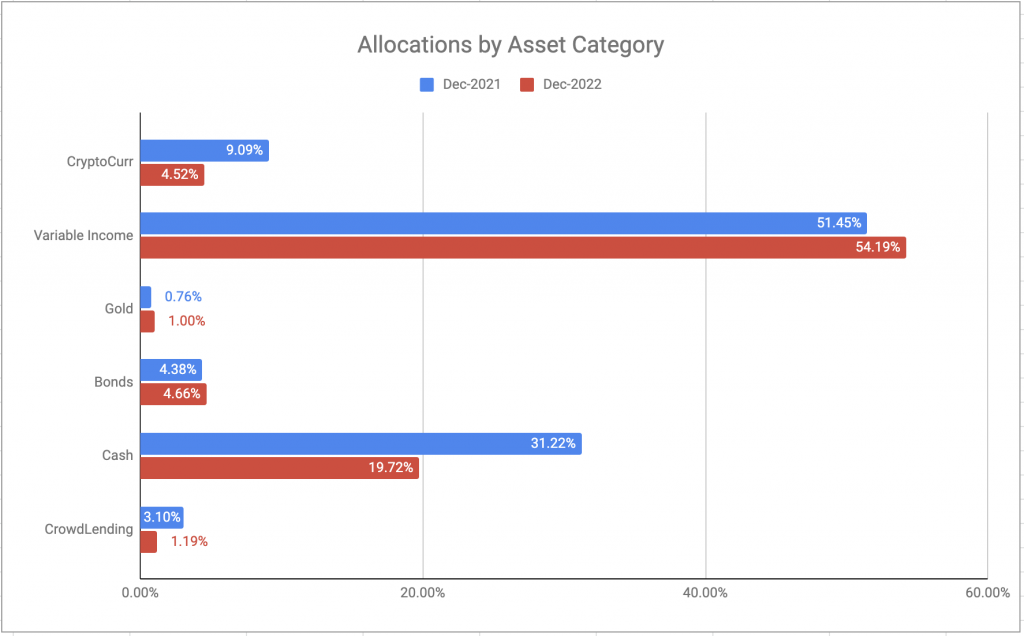

The next plot compares the portfolio allocations from the beginning of the year with the ones at the end.

- I am trying to cash out from Crowdlending on all platforms, almost done, just residual now. This was one of the financial objectives of the year.

- The cryptocurrency was the asset that performed worse and bought a bit the dip.

- My cash reserves decreased after buying the house, still holding and accumulating.

The following chart shows another view of my allocations, which is very strongly dependent on variable income.

Plans for 2023

This year I’d like to focus on:

- Evaluate buying a rental property if market prices decrease.

- Continue accumulating cash in early 2023 and find investment opportunities in late 2023.

- Continue eliminating exposure the crowdlending.